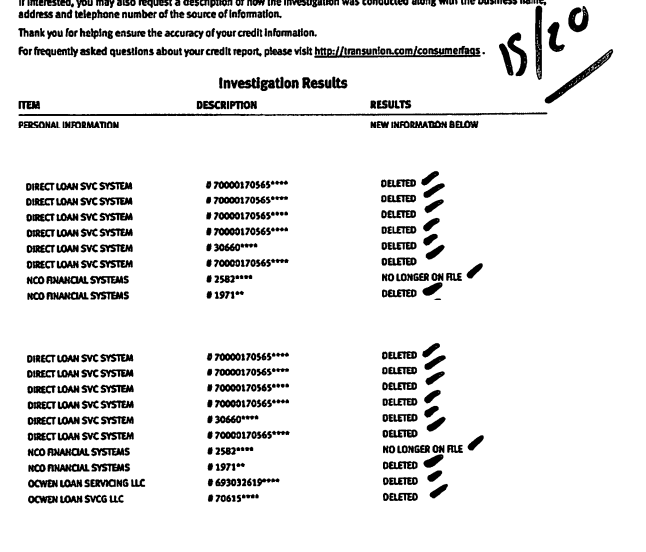

Derogatory Accounts – 15 Removed in 45 Days

Check into the outcomes right here. This client has been combating on her very own for more than 6 months trying to get rid of the adverse selections on her credit report score report with no success. Within 45 days we managed to aid her in the elimination of greater than 15 adverse credit records. The documents contained incorrect public papers, late payments as well as collections.

Credit repair is a battle that is not always won in such a short period of time. In certain cases though, we can quickly expedite the removal of in-acurracies. This client contacted us thinking that her credit could never be repaired. We met with her, did a consultation and reviewed each and every item on the credit report. After that we had her enrolled without paying any up front fees. We also set her up with online access to track her progress.

Check out the results below. You will find the name of the account on the left side, then the outcome of the credit bureau investigation on the right side. The responses from each dispute come directly to the consumer so you are able to see for yourself what changes will happen.

If you are concerned about signing up for a service without having the correct information up front, contact our team. We will review things first with you to ensure you are a good candidate. If you are not, you will still leave the Sign Up for $0 with quite a bit of credit education.

Also, keep in mind that results may vary in the credit repair process. Many websites will only show you the greatest results. With our company we prefer to show you estimates and take you through the details of the process. Our clients love this about our company. Also, feel free to check out our client login tab above to access your client portal. This service does not cost you a cent in addition to our service fee and gives you full access to the work we will be doing on your behalf. It’s a great tool to view your progress, track your dispute letters and to see your documents all in one place.

For even more information regarding the credit repair work procedure get in touch with our office for a free of cost appointment. If you don’t have a credit report, our credit desk can order one for you as well. You can email them at creditdesk@keycreditrepair.com to start that process as well.

Insight On Credit history Repair service For Everyone

The process of credit rating maintenance and repair could be the key to recuperating from unanticipated monetary grief. Only by obtaining a comprehensive understanding of the basics of credit report repair work, will you be prepared to navigate exactly what can be a confusing landscape. By using the recommendations had in this short article, you will be off to an excellent beginning.

Only make use of trustworthy recommendations on credit rating repair service, a lot of times just taking that from experts. There are a number of sources online that supply credit report repair insight, however that doesn’t mean you could rely on everything. There are numerous sources online that could supply information that is out of day or inaccurate, which might be damaging to your credit history if you used it.

When attempting to repair your credit, do not be intimidated regarding creating the credit agency. You can require that they check out or re-investigate any discrepancies you find, and also they should follow up with your demand. Paying careful focus on what is going on and also being reported regarding your credit report document could assist you in the future.

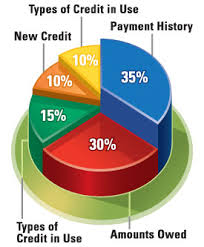

Utilizing a credit card sensibly could help fix your credit rating. When you utilize a credit card in a diligent fashion you boost your credit report history as well as pave the way for healthy credit report in the future. Consistently pay your bank card expense on time and do your best to pay off your complete balance monthly.

Produce a credit rating reconstructing strategy prior to you also think about doing anything else concerning your inadequate credit. You should know exactly what moves to make detailed and also ways to ideal strategy credit report maintenance and repair to profit you at the highest degree. If you produce a prepare for credit report reconstructing before you set out while doing so, you will certainly locate it much easier to get the outcomes you require.

Repairing your credit rating is not an over night solution. Ensure that you are totally dedicated to repairing your credit. Acquire arranged and also created different plans to assist repair your credit as well as make a list of what you really need to do. This will assist your success on your quest.

You should not shut or cancel aged credit card accounts when you are in the procedure of attempting to repair your credit rating. This is not such a great idea due to the fact that it will simply offer to make your credit past appear to be much shorter than it is in reality.

Inspect the terms and also interest prices if you have actually made a decision to attempt for a protected credit history card. The rates that banks bill to safeguarded card clients can differ extremely.

The principle of credit report repair service is something that is not constantly thoroughly realised. Nevertheless, effective credit maintenance and repair could be a blessing to anybody which has actually experienced monetary setbacks along the way. Making use of the recommendations and also tips included in this write-up, is a wonderful way to set on your own on the path to a much more steady economic future.

There are a number of sources online that supply credit report maintenance and repair advice, but that doesn’t indicate you can count on it all. When trying to repair your credit history, do not be daunted about writing the credit history bureau. Making use of a credit card responsibly can aid repair your credit rating. When you utilize a credit report card in a diligent manner you enhance your credit past and lead the way for healthy credit in the future. Produce a credit rebuilding plan before you even take into consideration doing anything else concerning your bad credit.

Nikitas Tsoukalis, President

Key Credit Repair