Do you want to improve your credit score? Do you want to do so quickly and efficiently? If so, you are in the right place! In this article, we will discuss five credit hacks that can help you increase your score quickly.

Whether you have a low score or you want to take your score to the next level, these five hacks will make the process easier and faster. You’ll learn the best ways to pay down your debt, find ways to improve your score, and make sure your credit history is accurate. Get ready to take control of your credit score and improve it quickly with these five credit hacks.

Pay Down Your Debt

Paying down your debt is one of the best and quickest ways to increase your credit score. To pay down your debt, start by paying off your most expensive debts first. These are typically the highest-interest accounts, such as credit cards and personal loans. Make sure to make all minimum payments due on all your accounts, but focus on paying off the most expensive debts first.

You can also use several strategies to pay down your debt faster. Consider consolidating your debt into one account and taking advantage of balance transfer offers. You can also switch to a lower-interest loan or look for zero-interest credit card offers. By taking advantage of these strategies, you can pay down your debt quicker and reduce the amount of interest you’re paying.

Check Your Credit Report

One of the most important credit hacks to help increase your credit score quickly is to check your credit report. Your credit report is a detailed record of your credit history, including information on your payment history, outstanding debt, and any other information related to your credit.

Checking your credit report regularly is important because it allows you to ensure that the information on your report is accurate, and can alert you to any potential problems, such as identity theft or inaccurate negative reports. Additionally, you can use your credit report to identify potential opportunities to improve your credit score, such as paying down existing debt or disputing any incorrect information.

You should review your credit report at least once a year to ensure accuracy and to monitor any changes. You can get a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year. It’s also a good idea to set up an account with a free credit monitoring service like Credit Karma and check your credit score regularly. Credit Karma allows you to monitor your score for free and provides helpful tips on improving it.

Increase Your Credit Limit

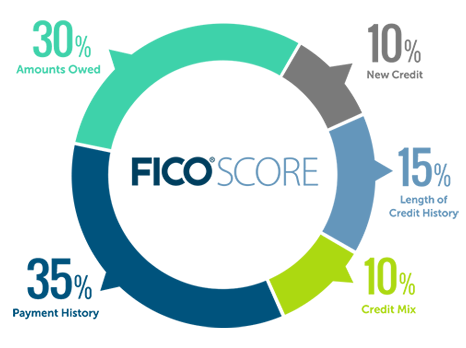

An important credit hack to increase your score quickly is to increase your credit limit. This will help you in two ways. First, it will increase your credit utilization ratio, which is the ratio of the amount of credit you are using to the amount you have available. The lower this ratio is, the better your score will be. Second, it will give you more purchasing power, which can be incredibly helpful if you have a lot of bills to pay.

The best way to increase your credit limit is to apply for a higher limit credit card. This card has a higher limit than the one you currently have, and it can be a great way to get more purchasing power and reduce your credit utilization ratio. You may also want to ask your current bank for a credit limit increase.

This can be a great way to get an increase if you have a good relationship with them, but it may take some time before you see an increase. Additionally, you can look into balance transfer cards, which can help you increase your credit limit and reduce your debt.

Increasing your credit limit is a great credit hack to help you improve your score quickly. A higher limit can help you reduce your credit utilization ratio, and you can use the extra purchasing power to pay down debt and improve your credit score.

Use Credit Cards Wisely

It is essential to use credit responsibly and pay off the balance in full each month. Paying your credit card bills on time is essential to maintaining a good credit score. If you are unable to pay off your balance in full each month, make sure you pay at least the minimum payment due. This will help you avoid late fees and interest charges, which can harm your credit score.

Monitor Your Credit Score

The final and perhaps most important credit hack is monitoring your credit score, as it’s key to keeping track of your financial health. It can be daunting to understand how to go about it, but it’s essential for maintaining a good credit score. To start, it’s important to know where your credit currently stands.

Once you know your credit score, you can use it as a benchmark to set goals and create a plan to achieve them. You should also plan to pay down any existing debt, such as student loans and credit cards. Make sure to keep your credit card balances low and pay off debt as quickly as possible. And if you have any past-due accounts, make sure to pay them off.

Keeping an eye on your report will help you spot any errors or fraudulent activity. If you find any discrepancies, you should contact the credit bureau immediately to ensure they are corrected. This will help you maintain a good credit score and protect your financial health. With the right credit hacks, you can quickly and easily improve your credit score.

For more help with credit counseling to help you increase your credit score, contact us at Key Credit Repair.