Should I file for bankruptcy?

Your Credit Minute Show Notes:

- 00:00 What’s up, everybody? This is Nik Tsoukales with Key Credit Repair. Today, we’re gonna talk about a word that has a super negative association, a word that people don’t really want to talk about, and that’s gonna be ‘bankruptcy’. Okay, so we get the question all the time: should I file for bankruptcy? And obviously for the sake of fair disclosure, we have to tell you we are not attorneys, we are not bankruptcy attorneys. What we are is credit repair specialists, but there are some very simple things to consider when you’re, uh, thinking of doing a bankruptcy, okay?

- 00:29 First of all, let’s talk about what a bankruptcy is guys, okay? So sometimes, we just use this one word, ‘bankruptcy’, but there’s, there’s more that goes into this. Okay, if you actually look up ‘bankruptcy’ in the federal court system, you’re gonna see what a bankruptcy is, is a protection, okay? So, the full phrase is gonna be ‘bankruptcy protection’, and what it is, is you getting protection from creditors when your finances have gone a little out of whack, okay? Recently, you’ve probably seen 50 Cent, a guy who’s worth, uh … You know, he’s been on the Forbes list of over $100 million and he had to file for bankruptcy. How does this actually happen and why should this happen?

- 01:12 Well, there are a couple of different types of bankruptcies, okay, and I’ll give you the pros and cons of both, and a couple of different super simple ways of thinking about this and approaching them, okay? So personally, you have Chapter 7 as an option and Chapter 13 as an option, and these are probably the two most common bankruptcy. Chapter 7 is really a full discharge of all of your debt. So, you can’t afford your debt, you’re falling on hard times, and what happens is you go to a, um … You go to your local bankruptcy attorney, they’re gonna file a petition in bankruptcy court, they’re going to get you protection from those creditors, from those creditors harassing you, okay, and then the judge is going to approve wiping out all of those steps. Those creditors will charge off those debts. They won’t get any payment from you, okay, and you’re gonna get a clean slate financially.

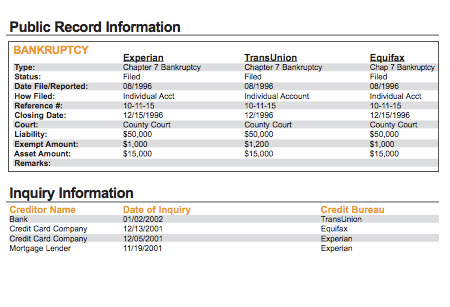

- 02:03 Now, that doesn’t mean you’re necessarily gonna get a clean slate in terms of your credit. Keep in mind that a bankruptcy is a ten-year mark, okay? Ten years and any time you apply for something, they’re gonna ask you, “Have you, uh, filed for bankruptcy in the last ten years?” It’s quite common. I mean, even if it doesn’t come up on your credit report, most applications are gonna have a little checkbox. Keep in mind, even if it doesn’t come up on a credit report, it does come up on a public records search because a Chapter 7, a Chapter 13, any sort of bankruptcy is a public filing. That information is accessible by the public, okay? It doesn’t mean they’re putting that information on a billboard. No one’s to see it. (laughs) But, it is there in the court’s records, okay?

- 02:45 The second type of bankruptcy that is extremely common is Chapter 13, and one type of bankruptcy that I really think is almost silly for most people. A Chapter 13 is a reorganization of your finances. So, let’s say you have, you know, 15 credit cards, um, you’re a business owner, things falling apart, you’ve, you’ve put yourself on the line personally. Things, things are, are, are … The business didn’t go well and now you’re on the hook for all of these credit cards, okay? But, the business is still going pretty well, okay, or maybe not as well as you want, but it’s still there, it’s still viable. Okay, that’s usually when you file for Chapter 13, and the Chapter 13 works a little bit like … Kind of like a debt consolidation or almost like a debt relief plan, okay?

- 03:27 So, let’s say you have these multiple creditors here that you have to pay, okay? Well, instead of paying them, you’re gonna be paying the court. You’re gonna be paying through a trustee. Okay, this is you. You’re gonna be sending money every month. That money or that amount is gonna be determined by the bankruptcy courts. It’s gonna be an amount that you can afford, okay? And then, the court system is gonna be distributing to each of your creditors until each of those debts have been paid off. That’s usually done over the course of a five year period, sometimes faster. Okay, keep in mind, though … Okay, let’s say you owe $100,000 in debt, okay, and you’re paying off this Chapter 13. You’re gonna pay that, plus court fees, plus attorney’s fees, okay? So, this could quickly turn into $115,000 in debt. I’m not a huge fan of a Chapter 13.

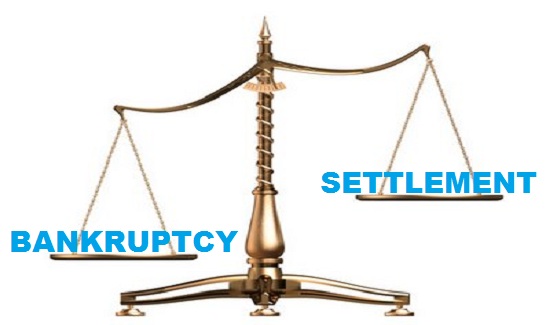

- 04:28 Okay, the only time in Chapter 13 really works is if you’re self-employed, okay? Um, if you’re not self-employed, typically what I suggest is some sort of a debt relief program, and a debt relief program works very similar to this, and the only difference is you’re gonna send your money into a debt relief company. That company is actually gonna save up that money with you, okay, and then they’re gonna use that money to negotiate settlements with each of those creditors, so that $100,000 that you owe could quickly turn into $50k. So, debt relief companies do a great job of negotiating down settlements, and as long as those fees makes sense, um, and they’re affordable and the company’s performance based, meaning they’re only making a percentage of how much they can save you, it’s a grand slam, okay?

- 05:17 The cons of that are it doesn’t offer you protection against those creditors. They can still call you, they can still harass you, they can still chase you, they can still sue you, whereas a bankruptcy, again, it’s ‘bankruptcy protection’, okay? You have protection from the court system. Those creditors cannot contact you, they can’t reach out to you, they can’t harass you. That stops. The court tells them, “Cease and desist. We’re handling things from here on end.” Okay? So, keep that in mind. So again, guys, get Chapter 7 as the big one. Chapter 13 is the one I don’t really like too much, okay?

- 05:50 Um, also, another suggestion is, you know, if you’re a consumer debt or if you’re, if you’re just a consumer, you’re not self-employed, okay, you’re not on the hook for a bunch of business debts personally, then che- Then, bankruptcy is something you really want to think, uh, you really want to think about, okay? If you’re on the hook for $4,000 or $5,000 in, in, in debt, um, bankruptcy might not be the move for; debt relief might be the move for you, okay? Um, consumer credit counseling might be the move for you. Okay, so I’d probably want to explore those options before I even consider speaking to a bankruptcy attorney, okay? Um, and the big reason is, again, that, that bankruptcy’s gonna stay on your credit report for ten years. That’s a pretty big mark, um, and it’s gonna follow you around for a long, long time, okay? What’s interesting, by the way, is I’ve had some people approach me and ask me: should I file bankruptcy, um, even though a debt is six years old? Okay, so the debt is six years old, but it’s big. You know, it’s $30k and all of a sudden, they’re just now getting harassed for the debt. The debt was fairly dormant and they’re wondering, “What should I do?” Well, in a scenario like this, okay, bankruptcy’s not a good idea because six years, this debt is gonna border the statutes of limitations.

- 07:05 If you’ve seen from my previous videos, depending on the state that you live in, guys, you could have a six year statutes of limitations where the debit comes un-collectable. You get up a five year/four year, um, and their basic reporting is only seven years, seven years plus 180 days from the date of last delinquency, so basically seven and a half years, okay? So, don’t go ahead and start paying attorneys to file bankruptcy and do all this crazy stuff if they’re just calling you, okay? You might actually want to stall a little bit if that debt is going to expire in the next month or so, or if it’s, uh, if it’s already expired, based on your state’s statutes of limitations, that’s worth a dispute and a cease and desist to that creditor, telling them, “Hey, you know, beat it. This, this is, this is a dead issue. You’ve written this off many years ago.”

- 07:50 So, guys, this is Nik Tsoukales with Key Credit Repair. Any additional questions regarding how you should approach or finagle bankruptcy versus credit repair versus debt relief, that’s a question our consultants can, can help answer all day and we can steer you in the right direction. Have a great day.