Credit Inquiries – Do They Damage Your Score?

For more buyer tips and information contact one of our consultants by dialing 877.842.5215 or requesting a free consultation below.

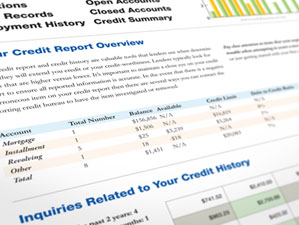

The Effects Of Multiple Credit report Inquiries On Your Ratings

Due to the fact that statistical studies show that numerous questions are linked with higher danger of default, Credit rating questions effect credit rating ratings negatively.

Credit Inquiries – Do They Damage Your Credit Score?

Distressed borrowers frequently speak to numerous lenders wanting to find one which will accept them. On the various other hand, multiple questions could additionally arise from applicants looking for the very best bargain.

To stay clear of penalizing loan “customers,” credit scores neglect questions that take place within 30 days of a rating date.

Expect, for instance, I shop a loan provider on June 30 as well as the loan provider has my credit scored that day.

Even if I had actually gone shopping 50 other loan providers in June and also they had all examined my credit rating, none of those inquiries would certainly influence my credit history on June 30.

Queries from May and back 11 months would certainly, nevertheless, be relied on June 30.

To avoid prejudicing the credit history from earlier shopping episodes, the markers manage all inquiries that happen within any 14-day period as a solitary inquiry.

They would count as one inquiry if you shopped 50 lenders throughout June 1-14. They would certainly count as 2 questions if you spread them over June 1-28.

You will certainly harm your credit report if you disperse your financing shopping over many months.

Due to the fact that the market can change from day to day, it makes little sense to do this in any kind of case.

Situations could trigger a consumer to shop, leave of the market, and also return later when disorders are more favorable.

You lessen the damaging effect by focusing each shopping episode within 14 days or less.

More about inquiries…

Do You Know The Difference Between A Hard and Soft Inquiry?

Are you trying to obtain a credit card with a truly great price? You could have been shopping around for a while to make sure that you could acquire the best feasible bargain. Opportunities are, you could have located a few various cards that you like, yet there were a few things that you did not like regarding every one. In some cases, you will certainly discover one that you like but you need to pay a yearly cost. Various other times, you will discover one without any yearly cost yet there will certainly be truly higher late costs or various other miscellaneous costs.

Looking with all of the terms for each one of them is one point, but applying for all of them is one more. Were you mindful that making a number of queries could in fact hurt your credit report rating?

The what’s what is, every time that you secure a bank card or ask about any sort of sort of a financing or installment plan, the details will certainly turn up on your credit rating report. This is called a “hard inquiry”. Many times, folks will get various type of credit history while they are entirely uninformed that the questions are breaking their credit report. It is in fact too bad that this info is not provided these individuals up front to make sure that better selections might be made.

One more common misconception is that an asking for a copy of your credit rating record can really harm you. This kind of a questions is called a “soft query” as well as needs to never count versus your credit history rating. If this kind of error ever appears on your credit record as well as it is showing versus you, it is very important that you go through the actions to deal with the mistake immediately.

Home loan Inquires

The credit rating reporting firms have made one exception. They have made it that numerous mortgage questions made within 14 days are addressed as one inquiry.

Several financial institutions will planning to understand the specific amounts of credit questions that you do have on your credit rating record. Relying on the guidelines of each lender, four or additional questions within a particular duration of six to 9 months could be taken into consideration to be very an excessive quantity. If they do consider this amount of credit inquiries as too much, they could wind up rejecting your credit history demand. This demand and denial will certainly then turn up on your credit history guide in addition to any others that you might have. All these inquiries will certainly harm your credit report. So pick what you obtain thoroughly as well as actually think about whether this new credit card or loan deserves dipping your credit report by a couple of factors

The fact of the concern is, every solitary time that you use for a credit history card or inquire concerning any kind of kind of a loan or establishment credit, the details will certainly reveal up on your credit history guide. Many times, people will use for different kinds of credit rating while they are totally uninformed that the queries are going versus their credit rating rating. Several creditors will look to see the specific quantities of credit report queries that you do have on your credit rating guide. If they do deem this amount of credit report questions as extreme, they could possibly finish up rejecting your credit history demand. Select exactly what you use for meticulously as well as really believe regarding whether or not this brand-new credit report card or loan is worth dipping your credit score by a couple of factors