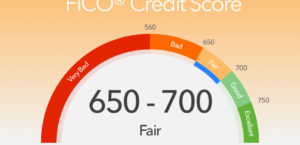

FICO Credit Score? A crucial aspect of knowing whether or not you’re in need of credit repair is obviously learning what your actual credit score is. After all, those crucial three digits are what lenders look at when deciding how at-risk of a consumer you are and whether or not your application should be approved or denied on everything from mortgage loans to auto loans to student loans. But how consumers attain this credit score information is a topic that has always been up for debate.

The aspect of how to attain credit scores recently made headlines again, as two of the leading credit reporting agencies in the United States were fined for allegedly charging consumers to check their credit scores – a practice viewed as unethical and misleading by the Consumer Financial Protection Bureau. In light of these recent events, the question remains: Should consumers pay for their FICO scores? Or should they rely on free avenues for attaining this crucial data?

FICO Credit Score. Where to Get Free?

Most experts advise consumers to check their credit scores and credit reports at least once a year. This is suggested even for consumers with very good credit, as checking such information annually can help detect potential errors and lead to quicker all-around fixes. Federal law permits consumers to attain credit reports free of charge from the three main credit reporting agencies once a year. Consumers that are looking to repair credit to make themselves more attractive on a loan or credit card application, however, may need to check their scores more frequently than annually to judge where they stand. The good news is that more and more outlets are making it easier to do this on a complimentary basis.

Here’s a look at some of these free avenues available for checking your FICO Credit Score:

- Your bank or credit union: Many financial institutions will offer free credit score checks for members. Some may even offer complimentary consulting services to help consumers reach their credit score goals.

- Your credit card company: Credit card companies like Discover now offer free credit scores to both cardholders and non-cardholders. Citi and Chase have similar policies. Others may provide your credit score if you simply ask.

- Websites: If you go the route of getting your credit score through a website, it’s important to make sure that the site is a credible one (i.e. CreditKarma) and that you aren’t supplying your credit card information for the service. Credible credit reporting websites will help provide you regular credit score updates, as well as provide guidance on potential purchases based on your score.

- Applications: Applying for a new credit card, car loan, or refinancing? As part of the approval process, the lender will be surely checking your credit score to make sure you qualify. Take advantage of this situation to learn what your credit score is.

We should note that you can buy your credit score. However, you should only ever consider doing so when you’ve either exhausted the options that we’ve listed above or if none of the aforementioned complimentary means of acquisition are viable for FICO Credit Score.