How much does a hard inquiry drop my credit score?

Your Credit Minute Show Notes:

- 00:01 What’s up YouTubers, this is Nik Tsoukalis from Key Credit Repair. Today, I’m going to address something very serious. Something that, for many of you, has made you quite sad. Hard inquiries. Okay? Some of you think this is devastating, this is the end of the world, you know? First, let’s talk about what is a hard inquiry. A hard inquiry is not when you check your credit score online, it’s not when you’re going to Credit Karma, or Privacy Guard, or Smartcredit. com. Anytime you’re checking your credit score for the purpose of credit education, credit monitoring, it does not hurt your credit score. A hard inquiry is a record that’s placed against your credit report when you are checking your credit for the purpose of blending, for being extended credit. Okay?

- 00:48 And the question I get all day long is how much is my credit score going to drop if I have my credit checked? How much, how much, how much, how much, how much? Is my credit going to be destroyed? Is my credit destroyed? I’ve already checked my credit a few times with a few banks, is it over? Am I never going to get approved for something again? And the short answer to that is you are insane. You are insane. Stop listening to this craziness that hard inquiries are destroying your credit. It’s just false, it’s wrong, it’s totally not true.

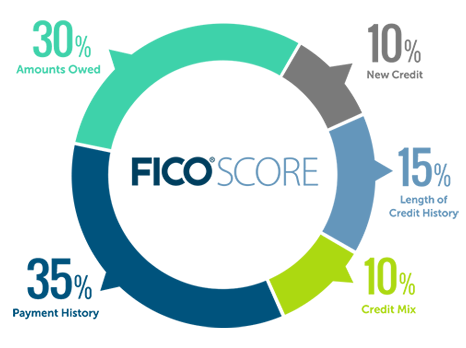

- 01:25 So let’s elaborate a little bit on this. So I’m going to reference my boys over at myFICO. com. If you’re not sure or not aware who FICO is, it’s Fair Isaac Company. Do you know those guys that invented credit scores? They tell us how inquiries affect your credit score. So I’m going to share this article below in the comments, but in the credit education section of myFICO.com, you can actually search inquiries, and it’s the first question that’s up there, and I’m going to read it off to you guys. Okay? If your FICO scores change, they probably won’t drop much if you apply for several credit cards within a short period of time. Multiple inquiries will appear on your credit report. Looking for new credit can equate with high risk. Okay? But that’s not definitive.

- 02:16 But most credit scores are not affected my multiple inquiries from auto, mortgage, or student loans lenders within a short period of time. The short period of time is not defined. Guys, I’ve been doing this for 15 years, looking at credit reports for a long, long time. I’ve probably looked at, I don’t know, a hundred thousand credit reports, a couple hundred thousand credit reports. It’s almost absurd at this point. I can read these things, I can use ESP to probably tell you what’s on your credit report. I’ve seen so many of these things. The short period of time, I’d probably say 60 to 90 days, okay? If you’re shopping around for something like a mortgage and you want to check out a few different banks and lenders, you want to do a little rate shopping, okay? Keep in mind, to get a proper quote, they need to check your credit score. Don’t be afraid of doing this. It’s not going to hurt your credit score.

- 03:13 FICO has told us, not just in this article but in multiple articles, that rate shopping increase are okay. So those hard inquiries, although they will appear on your credit score or your credit report, they’re not going to drastically drop your credit score. In fact, you may see absolutely zero drop in your credit score. In my experience, I have yet to see a credit report have any adverse effect, or credit score have any adverse effect from a hard inquiry. Guys, over a hundred thousand credit reports easily with my eyes closed, and I have never, ever seen a credit score drop because of a rate shopping inquiry.

- 03:53 Okay, you’re shopping around for a car. Go nuts, go do what you need to do. You’re an educated consumer. Mortgage, go nuts. Shop for five, six banks. You have to. You’re trying to get a good deal. Guys, if you’re getting a mortgage, you’re talking about a 30-year commitment, and you’re worried about your, the hard inquiry affecting your credit score? You’re talking about paying back a bank over 30 years. It could be millions of dollars in interest and you’re worried about the hard inquiry or maybe the 10 bucks you’re going to spend to check your credit report? It’s insane. Same thing with a car. You’re paying back that car loan over the course of 5, 6, 7, sometimes even 10 years, that’s a lot of interest, so you got to make sure you’re getting a good deal.

- 04:33 Um, now, for the first part of this, this answer, um, keep in mind, erratic behavior on your credit report could have an adverse effect. So, um, let’s say you decided to check your credit report a couple times with a credit card company, a couple times with the student loans company, a couple of personal loans, a couple of car loans, five or six mortgages, a few personal loans, and you did this all in one day. Okay? The credit scoring formula is designed to assess risk, okay, to protect future banks and lenders from making a wrong decision in terms of extending you credit, okay? So rightfully so, you could see a drop in your credit score. That’s a red alert. You are now a red alert, okay, maybe you’re a flight risk, maybe you’re about to leave the country forever and ever.

- 05:25 I’ll give you an example. You’re about to leave the country forever and ever, you’re never coming back, and you decide, hey, right before I head out of this place, I’m going to go nuts. I’m going to buy a bunch of stuff, I’m going to get a Macy’s card, a Target card, a Walmart card, a few personal loans, a few car loans. I don’t know what you’re going to do with a car loan. A few lines of credit, and you’re going to go crazy. You could be considered a flight risk, and that’s the only case where you could see a drop in your credit score. And I have to tell you, that is extremely rare. I’ve never seen it before, but that’s what we’ve been told by FICO on numerous occasions.

- 06:03 So guys, hard inquiries, if you’re doing it for the right reasons, don’t be scared of it. Do it, trust your lender. They know what they’re talking about guys, and they’re not going to drop your credit score. Okay? Um, and I’m going to squash one more misconception or one more myth, okay? Or make you guys aware of something. If you’re monitoring your credit score online, you’re on a Credit Karma, you’re on a Privacy Guard, you’re on a ScoreSense, you’re on any of these websites, keep in mind, most of these websites are not using the Fair Isaac Company Scoring method that banks and lenders use, which is typically a, kind of an older version, which is like FICO 4 or FICO 5, okay? These are 20-year-old scoring formulas. They’re using things like VantageScores, um, Credit Plus scores, those scoring formulas are not used by banks or for educational purposes only, but they’re also for marketing purposes.

- 06:54 So they have an incentive to tell you that the world, um, is going to be over because you just had an inquiry. And the incentive they have is when they send you an email saying you just had an inquiry, red alert, login to the website, check the app. They’re going to offer you something. You’re going to login to the app, that’s the bait to get you to login to their app, and when you login to their app, what’s there? There’s a banner for a credit card, there’s a banner for some sort of marketing affiliation they have, there’s a banner for something, and they’re making money on those offers. Because most of these credit reporting companies, what are they? They’re marketing companies, they’re marketing platforms. You get your credit report and score for free, you login, every time you login, they’re marketing something to you. They get your data, they’re reselling it to companies, all this jazz, okay?

- 07:44 So they really, uh, have been pushing this inquiry myth in a big, big way, to get people to login to their websites. Red alert, you’ve had an inquiry, the world is over. Um, new world order is taking over because of inquiries. Login quick, we will save your life. It’s false, it’s a lie, it’s garbage, okay? So guys, in terms of inquiries, that little frown, let’s turn it upside-down. Why don’t we do this together. Okay? Let’s smile. Do your job, do your rate shopping. Guys, this is Nik Tsoukalis with Key Credit Repair. Thank you for checking out our Credit Minute. Subscribe up here, down here, depending if you’re on Facebook or YouTube. Check us out for a free consultation, our staff is standing by, and have an amazing day. See you guys.