How Much Interest Will You Pay in Your Lifetime? -Tips

Nobody likes to pay interest, but it’s a necessary evil for large purchases such as a home or a car, as well as part of the deal when you charge items with a credit card. (To really make your stomach churn about the interest that you’re paying, all you need to do is take a glance at your mortgage the next time a bill is due.)

But if we were to ask you how much total interest you pay throughout your lifetime, would you know? What would your guess be? $100,000? $200,000? Something greater?

The amount of interest you’ll pay throughout your life certainly depends on a variety of factors

your credit card limit and spending behaviors and your credit score. But according to a report on Credit.com, a site that has developed a tool to calculate how much interest you’ll pay over a lifetime based on the purchases that you’ve made, the average American can expect to pay $279,000 in interest. To put this number into perspective, consider the fact that recent estimates have stated that the cost of raising a child, from birth to 18, is $245,000. So yes, if you’re an average American, you can expect to pay more in interest than you would to raise a child.

Scary, we know. Thankfully, you can take measures to ensure that you’re more than just the “average American” when it comes to interest to curb this $279,000 number. The most obvious means is to save and pay cash for all of your purchases. After all, an additional $279,000 back in your pocket over a lifetime sounds pretty good to me, no? But that’s certainly not practical for everyone. With that in mind, here’s a look at some practical advice to reduce those lifetime interest payments:

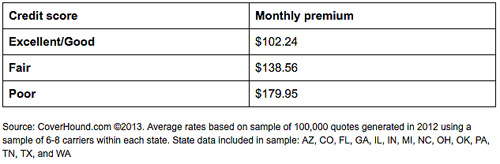

Raise Your Credit Score

It’s worth noting that the $279,000 lifetime interest payment is based on someone with a fair credit score (620-679). So if your credit score is better than fair, you’re going to be paying less than the average American over the course of your lifetime due to your status as a more trustworthy consumer, which comes with lesser rates. Is your credit not up to par? Enact some credit repair strategies to improve it, as well as your finances:

- Pay bills on time: Payment history accounts for 35 percent of the FICO score, the largest single category.

- Reduce credit card debt: If your credit card debt is greater than 30 percent of your total credit allotment, your score will suffer. To boost your FICO score, pay down debts so that you owe less than 30 percent of your limit.

- Credit history, types of credit and new credit are other factors that contribute to your score, but aren’t weighed as heavily as the two aforementioned categories.

Refinance Loans

Perhaps you took out an auto loan or bought a house when your credit score was just “fair” and now it’s “excellent” – you don’t have to continue to pay your bills with the interest rates that came with a fair score. Consider refinancing old loans if your credit status has changed to lock in lower interest rates. Check with your bank or credit union to see what interest rates are at and consider pulling the trigger and refinancing when rates are low enough. It doesn’t take long and can pay big dividends.

Credit Card Tips

The interest you’ll pay over a lifetime on credit cards come in a distant third place compared to interest on home loans and auto loans for most consumers, but it’s still a category worth focusing on. There are a number of things you can do to reduce interest payment, such as:

- Pay on-time, in-full: Only charge what you know you can pay off.

- Make multiple payments each month: Making more than one payment per month, even if you can’t completely pay the card off each time, can help lower your balance and thereby your interest.

- Negotiate a lower rate: If you’re unhappy with your credit card interest rate, just a simple phone call to inquire about the possibility of getting a lower rate can work sometimes, especially if you’ve had the card for a long time.

- Shop around: Not happy with your current interest rate? Shop other cards.

A final tip when it comes to charging is to seek alternatives for large purchases. For instance, instead of charging furniture when furnishing a home, look for a store that offers a 12- or 18-month same-as-cash payment plan. You can do the same with large medical bills – go on an interest-free plan if it’s paid off within a certain period of time.

Just because the average American pays $279,000 in interest over their lifetime, it doesn’t mean you can’t deviate from the norm. For more information on how to repair your credit score, feel free to Sign Up for $0 below.