Charge-Off – What exactly is it?

Keeping your credit score high is incredibly important for many people, particularly those who rely on debt to finance homes, vehicles, or anything else that may come up throughout life. Paying bills on time is an important part of keeping your credit score high. On the other hand, failing to pay bills can result in a dramatic reduction of your credit score. One of the worst things that can happen to your credit score is for your of your creditors to report a “charge-off” on your credit report.

What is a charge-off?

A charge-off occurs when a creditor – such as a credit card company, bank, or anyone else with whom you have signed an agreement to pay a debt on a specific basis – decides that they are no longer willing to wait for you to pay a debt that you owe. Typically, this occurs after months of attempts to collect on the debt, including multiple letters and even delinquencies on your credit report.

The charge-off itself occurs when the creditor sells your debt to another company (typically a debt collection agency) for pennies on the dollar. In other words, a $10,000 debt will be sold for as little as a few hundred dollars. Creditors are willing to sell the debt for such a small amount because they do not believe they will get paid by the debtor (or they don’t think the effort it will take to collect is worthwhile). Debt collection agencies buy up this debt because they believe they will be able to earn more (on average) by attempting to collect on these debts.

Ultimately, however, the charge-off shows up as a major derogatory on your credit report, and results in a significant drop in your overall credit rating. Many creditors, specifically those offering auto loans and mortgages, will not lend any money to an individual who has unresolved charge-offs on their credit report.

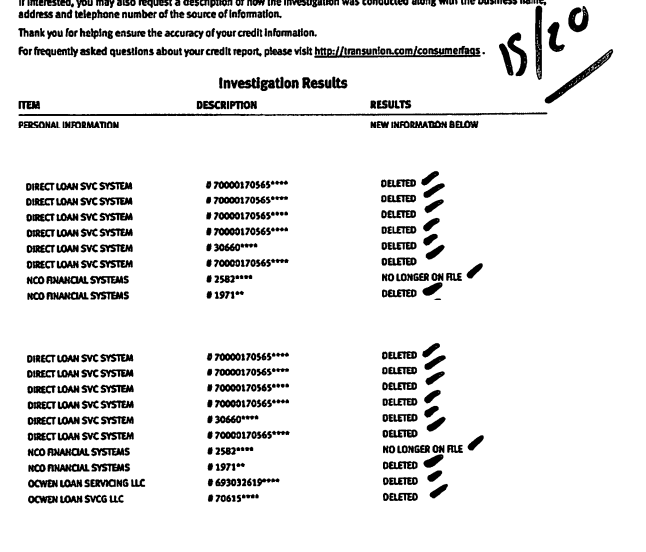

How long a charge-off stays on your credit report

Unfortunately, charge-offs stay on your credit report for a long time. The specific amount of time varies by state, however in most states they are legally required to be removed 7 years after they are reported. However, it is important to remember that the 7 year charge-off timer does not start when the debt is first left unpaid; the timer starts when the debt is initially charged off, which is typically about 6 months after the account first went unpaid. While a charge-off will have a diminishing impact as time goes on, they still have a significant impact until they fall off your credit report entirely. Also, it is important to remember that the debt is still legally owed by you even after it falls off your credit report.

How to get rid of a charge-off

Unfortunately, it is very difficult to get a charge-off removed from a credit report. The only way to have it removed entirely is to have the original creditor agree to a “pay for delete”, in which you pay off the debt in exchange for a complete removal of the charge-off. Most of the time however, the best you can hope for is a “closed” or “settled” notation, which debt collection agencies will agree to in exchange for a repayment of all or some of your owed debt. It is important to speak to a professional in credit repair when determining the best course of action.

For additional information and a comprehensive review of your credit report, feel free to Sign Up for $0 below.