How to Fix Your Credit – Credit Repair 101

650.

That’s your credit score. It’s not horrible, especially considering that the FICO score ranges from 300 to 850. But since it falls into the general “fair” category, it certainly isn’t prestigious as a score of 750, which is considered “excellent.” With this score, it wouldn’t be unusual to have to pay a higher interest rate than you would with a better score. Naturally, you want to repair credit, but how?

Here’s a look at some pointers on how to improve a poor credit score:

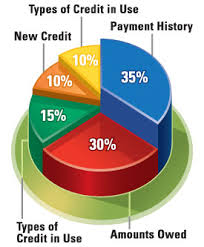

- On-time payment: Pay your bills on time! Even bills that are a day or two late can have a big impact on your credit score. If you need to, set up reminders or automatic payments.

- Check your report: Be sure to keep an eye on your credit report. Look out for errors – you’d be surprised at how often they occur. In fact, it’s estimated that up to 80 percent of all credit reports contain some type of error. If you find any errors, dispute them to help improve your score.

- Reduce debts: Come up with a payment plan to pay down the debt on major accounts. Focus on paying off the high-interest accounts first. With credit cards, try to keep the balance within 30 percent of your overall credit limit. This is key to credit repair.

- Credit cards: Don’t close unused cards and don’t open any new cards as a means of increasing your score or raising your credit limit, respectively.

- Do not apply for too many credit loans: When you apply for credit loans or get a new credit card, it automatically generates a hard inquiry on the credit report. Typically, these hard inquiries show up on your credit report for 2 years and can create a negative impact, pulling down your credit score. This is because too many hard inquiries can give creditors an impression that you are a risky borrower.

Questions may arise over your creditworthiness – Why do you need a new credit? Does that a sign of your financial instability? These are some red flags zones for lenders, which you should keep in mind when considering how to fix your credit score.

- Dispute Inaccuracies on Your Credit Report: Inaccurate information, errors and negative items on your credit report can significantly pull down your credit score. When you worry about “how can I fix my credit score,” it is important to check credit reports from all three major bureaus – TransUnion, Experian and Equifax – and verify that all information listed on your reports is accurate and correct. For any error or discrepancy, dispute the same and get it removed to fix your credit score.

And most importantly of all, use common sense. Don’t move debt around – pay it off. Manage credit cards responsibly and know the basics about your credit score and what can make it go down and up. If you feel like you’re really in over your head, consider consulting with a credit counselor who can help address your challenges for how to fix your credit score.

For more information on how to improve your credit score Sign Up for $0!