Vantage Scoring Model Updates- Everything you need to know.

What Is Wrong With the Old Model?

The current models lock out a lot of potential buyers who don’t have high FICO scores but who could still be relied on to pay their mortgage. People who do not have recent installment loan or credit card information suffer lower FICO credit scores. Smaller institutions like credit unions, payday lenders and subprime lenders may not properly report loan repaying information that would boost scores. By using a more up-to-date model, more people would have a chance to borrow for a home. Fannie Mae and Freddie Mac are considering allowing use of one more modern model, VantageScore 3.0.

Things to Know About The new Vantage Scoring Model

The new VantageScore will range between 300 and 850, which is the numerical scale used by other credit scoring models. If a borrower had a score between 501 and 570 under the old VantageScore model, he or she would have a score between 300 and 508 in the new one; this is a low score that indicates a bad credit risk. Someone who had a score between 851 and 870, however, would be considered an average borrower with a score between 763 and 780.

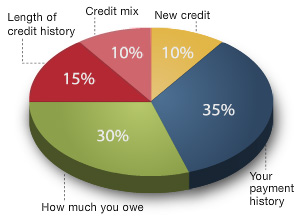

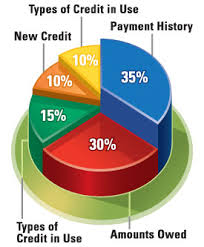

Your VantageScore is drawn from information that includes public records, credit inquiries, collections and credit accounts. Information from the past two years are considered the most important. Different credit use behaviors have different weights of influence on your score. The most important factors are:

- Your payment history (40% of your score)

- Depth of credit; that is, how much information is available (21% of your score)

- Credit utilization (20% of the score)

- Your credit balances (11%)

- Your recent credit use (5%)

- Your available credit (3%)

The VantageScore 3.0 leaves out a lot of information that hurt people in older scoring models. Any account that was in collections that has been paid in full is not counted. Less credit history is needed to calculate a person’s credit score, which means that more people are able to get access to credit sooner. This is a feature that can open credit opportunities for 30 million people. People who are victims of natural disasters are protected against negative credit records that can occur after such an event. The VantageScore’s reason codes are far more transparent, letting people know what has to happen for them to improve credit scores.

While the scoring method is the same for all bureaus, you may wind up with different VantageScores from the three credit reporting agencies. This is because they each use internal data that can contrast with what the other bureaus have.

The way to achieve a good credit score is pretty straightforward and similar to the classic advice. To get the highest score and get access to the best lending opportunities:

- Make all of your payments on time every month. This factor is weighted heavily in your VantageScore, so it has the most influence on your ability to get a loan.

- Keep your credit card balances low. When creditors see that you have used up a lot of your extended credit, it can look like you are not able to handle money responsibly.

- Only apply for credit when you need it. This way, new inquiries are not drawing down your credit score.