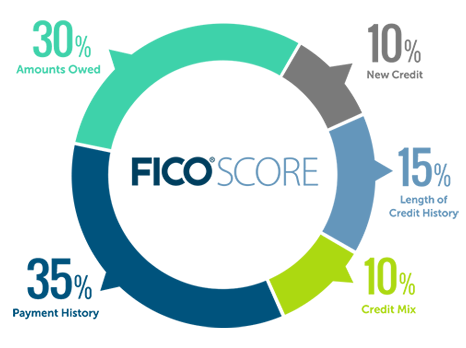

Credit Tip Of The Week: Credit Score Breakdown

Credit scores range from 300 to 850, with 850 being the best possible credit score. According to FICO, five different categories of information are used to calculate your credit score: Payment history, credit utilization, length of credit history, mix of credit and new credit.

Payment History

Your payment history is based on the payments you have made to credit accounts in the past. It is the single most important factor used in determining your credit score and accounts for 35 percent of the overall result. Account types considered in this part of the calculation include mortgages, auto loans, retail accounts and credit accounts. This part of the calculation also includes judgments, foreclosures, bankruptcies and other serious financial issues.

Credit Utilization

“Credit utilization” refers to the percentage of your available credit that is currently in use. The higher this percentage is, the more your credit score will drop. Using a large percentage of your available credit is considered poor debt management, and potential lenders see it as a warning sign that you may have trouble making payments if they extend you more credit. Credit utilization accounts for approximately 30 percent of your credit score.

Length of Credit History

The length of your credit history shows lenders how long you have been using credit. This part of the calculation considers the age of each of your accounts individually, as well as the average age of all accounts. The longer your credit history, the higher your score will be. Length of credit history accounts for 15 percent of your credit score.

Mix of Credit

In general, it’s best to have a variety of credit types, along with some accounts that are not currently in use. Different types of credit considered include installment loans, mortgage loans, finance accounts, retail store accounts and credit cards. Your mix of credit accounts for 10 percent of your credit score.

New Credit

FICO reports that opening several new accounts in a short period of time indicates a higher credit risk. Thus, if you open multiple new credit accounts quickly, your score may fall. New credit accounts for the remaining 10 percent of your overall score.