BBB Review – Testimonial

Testimonial

“Key credit repair gave me hope .. i always wanted to fix my credit but i did not know where to star knaw am so happy that after 3 month i have seen great result i just hope that for april everything will be clear god bless them because they do great job and they do what they said they will do for you”

J.S. -Boston Ma

P.S. Here is a great article discussing how credit works.

How Does Credit Work?

Credit history Rating Scale: Exactly how It Is Done and also Just what It Does To You

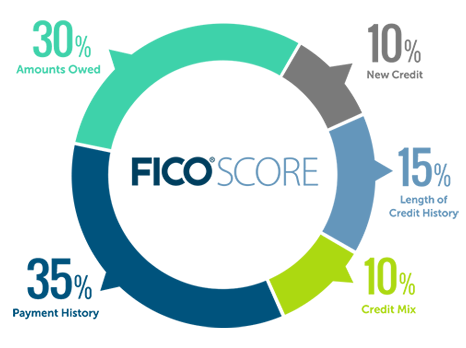

The original credit scoring formula was created by Fair Isaac & Company, or FICO as they are referred to. Today there are hundreds of different algorithms that calculate risk but FICO is still the primary company. Below you fill find some “ins and outs”. If you find this a little confusing I would suggest a call into our team. Let us break down how these factors affect your score.

Your credit rating record is an essential record that lenders, particular property managers as well as specific firms will take a look in order to determine your reputation. For financial institutions and credit card companies, they take a look at your credit rating past in order for them to establish if you are an individual that pays bills punctually. This implies that when you secure a credit rating or a lending card, banks, lenders, and bank card companies will certainly determine if you will be accepted for the funding or the credit card or not by just examining your credit past as well as having a look at your credit report.

It is really essential for you to understand exactly what a credit report rating in fact implies to you and your future. Not lots of Americans understand exactly what a credit rating is. A bad credit report score will certainly mean the rejection of acquiring accepted for a phone line in your very own house.

Of all, lenders, such as financial institutions, lenders, and the credit card company will certainly make records regarding your credit report history to credit reporting companies. If you do not pay your expenses punctually, the lenders will certainly be making adverse guides and send them to credit report reporting firms. This will injure your credit history.

It is crucial for you to keep in mind that your credit rating isn’t static. Your credit report score or your credit history rating adjustments all the time.

You can purchase it via the three major credit bureaus in the United States if you don’t know just what your credit report score is. The credit card guide can be gotten for free each year. You could buy all of it simultaneously in order to compare it as well as detect some mistakes that might be harming your credit score.

By doing this, you will certainly have the ability to examine your credit report before you secure a credit or a lending card. This will certainly additionally add to a bad credit record if you used for a credit history or a loan card if you have a bad credit history score.

So, it is extremely important for you to learn about your credit report prior to you even think of making an application for a loan.

Constantly remember that having an excellent credit history will certainly suggest getting great apartments, acquiring several of the fundamental needs, such as a phone line in your house, acquiring the most effective finance bargains, as well as obtaining the best bank card deals.

By having a great credit report, you will increase your opportunities of getting financings and other economic possibilities that could cross your road in the future. Constantly keep in mind that your credit history indicates a lot in today’s society. Maintaining a good credit report ranking nowadays is a must.

For bankings as well as credit report card business, they look at your credit record in order for them to identify if you are a person that pays costs on time. This implies that when you apply for a financing or a credit card, financial institutions, creditors, and credit rating card firms will certainly identify if you will be authorized for the financing or the credit rating card or not by just examining your credit rating past and also taking a look at your credit rating rating.

Of all, creditors, such as financial institutions, lenders, and also the credit report card business will certainly make guides regarding your credit report past to credit reporting agencies. Your credit report rating or your credit history score changes all the time. If you do not understand exactly what your credit history score is, you can order it with the 3 significant credit history bureaus in the United States.

For additional information on how to repair your credit, please Sign Up for $0.