5 Fascinating Things You (Probably) Didn’t Know About Credit Scores

You’ve heard the old adage about how “knowledge is power,” and perhaps nothing demonstrates this saying more than when it comes to knowing about your credit information. Yes, the more you know about these details of your consumer history and you’re able to make better decisions when it comes to your future behavior.

First and foremost, it’s important to know your credit score, but it’s never a bad idea to brush up on some of the more intricate details that shape your score.

Here’s a look at five things you probably didn’t know about credit scores:

5 Interesting Credit Score Facts

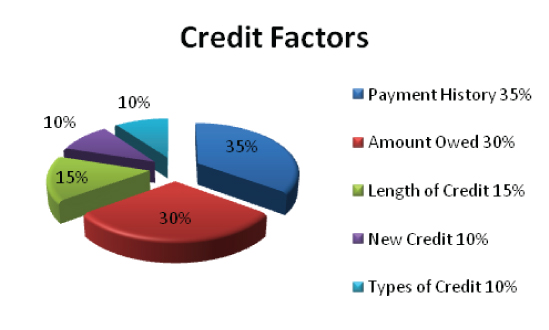

- The big 5: Do you know the five factors that go into calculating your credit score? You should! Payment history is the largest single factor, worth 35 percent of your score. It validates the importance of paying your bills on time. Credit utilization ratio is next, at 30 percent. For a good lender-friendly ratio, keep it at 30 percent or less. Length of credit history factors into 15 percent of the score, and new credit and your credit mix each account for 10 percent of the score.

- 700: That’s the credit score of the average U.S. adult. A score of 700 is considered to be in the “good” category. This “good” category applies to scores between 670 and 739.

- Do you know your score? If you don’t know your score, you aren’t alone. In fact, it’s estimated that three out of every five Americans don’t know what their credit score is. That’s 60 percent of the country, and there’s really no excuse for it based on how important that three-digit number is to your purchasing power and how easy it has become to access.

- Credit report doesn’t equal credit score: Up to 20 percent of all credit reports contain some sort of error. That’s why it’s a good idea to utilize your right to obtain a free annual credit report. But contrary to what many believe, checking your credit report doesn’t permit you access to your actual credit score. We know it seems odd, but that’s the way it works. To get your score, check your credit card statements, subscribe to a free credit check website or talk to your bank or credit union.

- Late payments can do terrible things to your score: As we noted above, payment history is the largest consideration factor when it comes to calculating a credit score. Noting this, it probably doesn’t surprise you that late or skipped payments don’t bode well for your score. But what you may be surprised to learn is just how hurtful they can be. In fact, a 30-day late payment could cause your credit score to dip an entire 100 points! The lesson: Pay your bills on time!