Public Records – How do they affect my credit score?

According to BSC Alliance, it’s estimated that anywhere from 1.3 to 1.5 million Americans file for bankruptcy protection each year. In 2013, Fox Business News reported that the IRS filed over 300,000 tax liens, or unpaid assessed money against your property or salary. Hundreds of thousands more Americans have court judgments filed against them.

According to BSC Alliance, it’s estimated that anywhere from 1.3 to 1.5 million Americans file for bankruptcy protection each year. In 2013, Fox Business News reported that the IRS filed over 300,000 tax liens, or unpaid assessed money against your property or salary. Hundreds of thousands more Americans have court judgments filed against them.

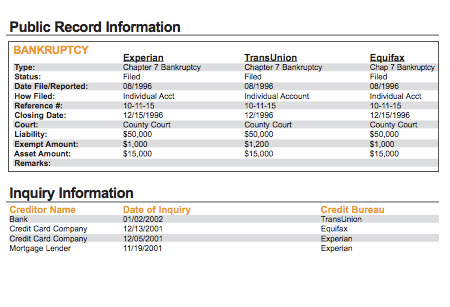

So just what do bankruptcy, tax liens and court judgments have in common? They’re all types of public records – or public legal documents – that can appear, linger and negatively impact your credit score. In fact it’s estimated that bankruptcy alone can dock an otherwise good credit score of up to 200 points. But that might not be the worst part about this public record. Arguably the worst part about bankruptcy is that it can stay on your credit report for up to 10 years, if credit repair or debt management strategies are not applied.

Yes, for bankruptcy – as well as many other types of public records – one way to repair credit is to wait out the years until it expires from your credit history. It goes without saying that a key credit tip to maintaining a favorable score is to avoid these public record pitfalls. Here’s some additional information on public records and how it can impact you:

- Bankruptcy: We already covered a bit about how filing for bankruptcy impacts your credit score and how it can stay on your credit history for 7 to 10 years, depending on which Chapter you file for. Having a bankruptcy removed from your credit report is challenging and will require several disputes, but it is possible, as long as it has been discharged.

- Tax Lien: Tax liens are filed either against your money or your property, indicating that you owe money to the IRS. But tax liens work a bit differently than bankruptcy and other public records. That’s because after you pay a tax lien, it is “released.” And although even tax liens that have been released can stay on a credit report for up to 7 years, you can contact the IRS and request that the released lien by withdrawn. If your request is granted, the lien is removed from your credit report immediately.

- Court judgment: Judgments are filed after you lose a trial or ignore a lawsuit and a court grants the opposing party the right to claim money, property, etc. from you. After they’re filed, they’ll stay on your credit report for up to 7 years. Additionally, judgments can be re-filed within that 7-year span and tack an additional 7 years onto the time it will impact you. Needless to say, it’s wise to avoid judgements, whether it be with a creditor, landlord, etc. So if you believe a court date is imminent, do what it takes to explore settling outside of the courthouse. Your credit score will thank you for the next seven years.

- Other public records: Other types of public records your credit score could be burned on include foreclosure, wage garnishment and past due child support payments.

Public records can be a burden to your personal finances as well as your credit score. So try to avoid them, if at all possible. But if you can’t, it’s important to know what to expect. For additional information feel free to Sign Up for $0 below.