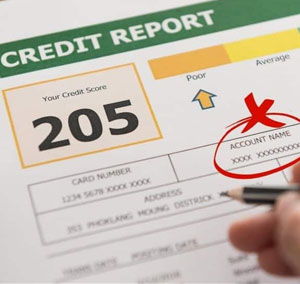

Credit Mistakes – 68% of Americans Make Them

That’s right, according to a recent survey conducted by Credit Karma, some 68 percent of all Americans have at least one negative mark on their credit report. According to the survey, such marks often include maxing out a credit card, late payments, defaulting on a loan or having an account sent to collections. About three out of every four respondents stated that they believed the credit mistakes had a negative impact on their life.

Needless to say, but the more severe the blunder, the more it will impact your credit. What’s more is that such penalties can stay on your credit report for up to 10 years.

Avoiding a Credit Disaster

While it makes sense that a younger age demographic would experience more credit mishaps than a more experienced one (live and learn, right?), the Credit Karma survey concluded that the best way to avoid a credit disaster among these youngsters is to be properly educated about the importance of your credit score, as well as how to manage personal finances. Bottom line: before you get that first credit card, know the importance of your credit score and the responsibilities associated with properly managing your finances.

Repairing Credit

If you’re among the 68 percent of Americans that did some damage to your credit score before you were 30 and are still paying the price, here’s a look at how to get that credit score repaired and back into shape:

- Get under 30 percent: Always strive to have your debt-to-credit allotment under 30 percent. For instance, if your credit limit is $10,000, try to keep the balance at or below $3,000 for the best possible credit score.

- Pay down debt: Always pay down the high-interest accounts first, as you’ll not only work toward a no balance account, but also save money in the long-term.

- Make payments on time: This is perhaps the easiest way to up your credit score, yet it’s one that people struggle with. The bottom line is that late payments can greatly impact your score, so do what you need to do (schedule auto payments, set phone alerts, etc.) to remind you when bills are due.

- Get a secured credit card: These cards require cardholders to put up “collateral” to obtain a credit line. They’re a great way to build credit and eventually can be helpful in the desire to apply for an additional, standard credit card.