Average FICO Credit Score Reached New Record Highs During the COVID-19

According to information that was published back in July, the average FICO credit score reached a record high, averaging 711. It may seem counterintuitive that average credit scores are continuing to go up in the midst of a global pandemic. The reality is that numerous indicators show that the economy has struggled mightily in the midst of a global public health crisis. Tens of millions of people in the United States are currently unemployed, having issues paying their bills. On the other hand, it is important to note that average credit scores do not shift quickly.

FICO Credit Scores Are Not a Barometer of the Economy

FICO credit scores are not necessarily a barometer of how the economy is doing. Usually, there is a lag between a major economic event and how credit scores respond. For example, during the last recession (in 2008), FICO scores did not reach their nadir until late in 2009, nearly two years after the recession initially struck. Therefore, people should not be surprised if credit scores take a while to respond to the economic crisis triggered by the COVID-19 pandemic as well.

Why Are Credit Scores Going Up?

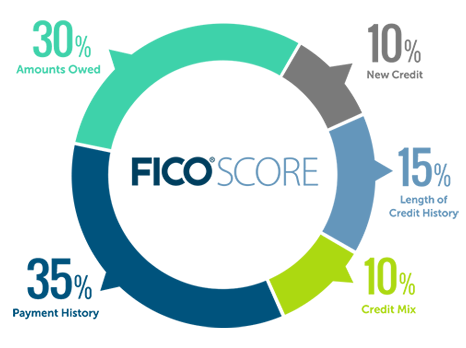

Credit scores remaining stable is one thing; however, why are they actually going up? There are a few reasons to note. First, the government acted en masse to pump more money into the economy. The CARES Act and the PPP put more money into the pockets of families and small business owners, making it easier for them to pay their bills and stay on track with their loans. The average number of borrowers who missed a payment actually went down in July compared to prior months. Given that on-time bill payments is more than a third of the FICO score, it is easy to see how this would increase credit scores. Finally, people are using this extra money to pay down their credit cards as well. This reduces average credit utilization, driving scores up as well.

Will Credit Scores Continue To Rise?

It is impossible to predict the future. If the economy gets back on track, this alone should help credit scores go up; however, with uncertainty surrounding another round of stimulus payments and many people still struggling to find work, the credit score boon might not last. Therefore, everyone should try to do everything they can now to pay down their debts and raise their scores.

Contact Us Today to Learn More About Credit Repair Services: Key Credit Repair!