Credit Scores and Car Insurance – Credit News

For instance, credit scores are also factored into things like auto insurance premiums. Yes, credit scores count for insurance too, which makes credit repair all the more important and quite the lesser known credit tip.

So just how is a credit score factored into an insurance premium? An insurance provider will typically base premium rates on an insurance score. And this insurance score takes into account your credit history in order to predict your likelihood of being involved in an accident or filing an insurance claim. Studies detail how credit history can be linked to risk and accident potential.

Here’s a closer look at a credit-based insurance score and why it’s important that you repair credit for more than just good interest rates on loans:

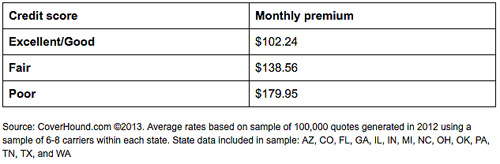

- The higher your credit score – and thereby your credit-based insurance score – the greater the likelihood that you’ll qualify for low auto insurance premiums. Keep in mind that this premium also takes into consideration driving history and the amount of claims on your record.

- If you have a low credit score, you’re more likely to pay more for your auto insurance premium, as you’ll likely have a lower overall credit-based insurance score.

If you have less than stellar credit, what can you do to improve it for auto insurance purposes? The same thing you would do to improve it for any other purpose:

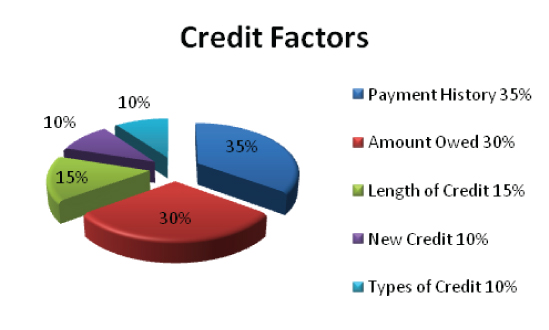

- Make sure payments are on time.

- Open new credit lines in good standing.

- Have a favorable credit history (i.e., no collections, missed payments, etc.)

- Good debt management – try not to accrue more than 30 percent of your total credit line at once.

Yes, good credit is about more than just low interest rates on loans – it can also net you lower auto insurance premiums. So if your credit is lacking, take measures to get your finances in order today.

For more information on how to repair your credit, please Sign Up for $0 Today.