Credit Karma Vs. Everyone

Your Credit Minute Show Notes:

- 00:00 Hey, what’s up YouTubers, this is Nick Tsoukales with Key Credit Repair. Guys, today we’re going to talk about credit karma. The question I’m getting consistently is, “Why is my Credit Karma credit score, so much different from what the banks and lenders are using?” Everyone’s going after Credit Karma these days online. Every blog is talking about Credit Karma, it’s the free site, everyone’s using it, and we’re going to call this video Credit Karma Versus Everyone. Okay? So let’s break down why your Credit Karma score is different. And there really is a very specific reason why your Credit Karma score would be different than what the banks and lenders are using, and the main reason really is the scoring formula. So keep in mind, you have various different scoring formulas out there. Okay? The one I always talk about is going to be our good friend, Mr. FICO. Okay? The FICO score invented by Fair Isaac Company, that has always been the crème de la crème. That is the scoring formula that every bank and lender is using for pretty much everything.

- 01:01 The latest version of FICO is FICO 9, produced in 2016. Um, it’s a scoring formula that banks and lenders really aren’t using, okay. Most mortgage lenders, for you guys trying a home loan are using FICO 4, FICO 5. It’s an older version, it’s got to be a good 20 years old. Uh, but FICO is what the banks and lenders are using. Okay? Now, and then obviously they have you know, FICO 8 and FICO 9, those are for educational purposes only. Keep in mind, there are a good five or six different recent versions of FICO that are used for different purposes as well, there’s the car lending score, the auto lending score, so on and so forth. But we’ve covered that before. Okay? Um, Credit Karma is not using FICO guys, it’s using something called Vantage. So your VantageScore, excuse my bad handwriting, so you’re wondering, what is the VantageScore?

- 01:55 Well, a few years ago, the three, the three credit agencies, you have the big three. Experion, TransUnion and Equifax, okay, they got together and they actually created um, they formed a team and they created this new scoring formula called VantageScore. Okay? The reasons behind it, eh, you’ve got to wonder. I would say probably a big reason if I was in the scoring uh, business, would be to really bypass the licensing fees that they were paying to FICO every time they used FICOs algorithm, because essentially what they’re doing is they’re paying FICO a fee to use that scoring formula. So essentially what it is, they came up with their own formula. Okay? That formula is showing up on all types of websites. The first website that we really show AdvantageScore show up in, show up on, was a website called truecredit.com. For any of you that have been monitoring your credit for more than a decade, you probably remember TrueCredit. TrueCredit was TransUnion’s credit monitoring site and it was super-duper popular and pretty inexpensive. It might even still be up right now, but typically most people are accessing the TransUnion data directly through TransUnion.

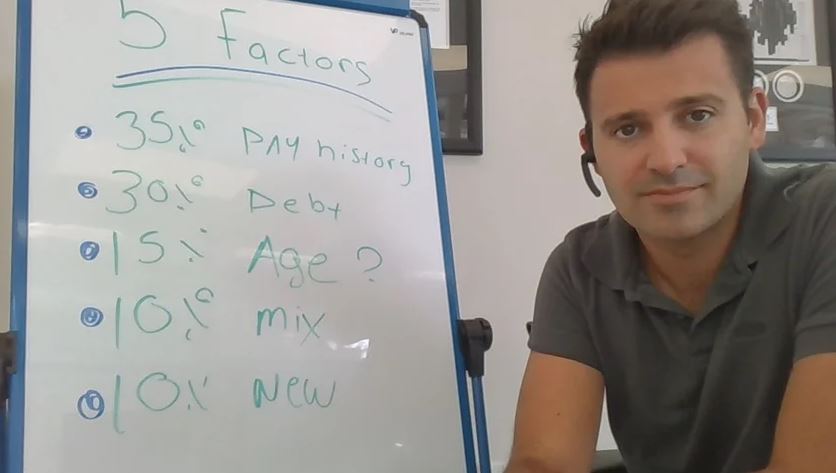

- 02:57 Now, when Credit Karma showed up to the party, they were offering a free credit scoring formula. They were doing it in conjunction with TransUnion, so they were offering the VantageScore pretty much automatically. Okay? Uh, they’ve now taken on Equifax as well, Equifax is also using the VantageScore through Credit Karma. Um, the one agency you don’t have on Credit Karma is Experion, which is okay, it is for educational purposes only, but again, there is going to be a difference between that FICO scoring formula and the uh, VantageScore. Okay? The main difference really, and I’m actually going to pull up these stats, is going to be payment history. Okay? So your FICO scoring formula is going to account for payment histories 35% of what makes up the credit score, whereas Credit Karma or VantageScore is going to take it into account as 40%. Okay? FICO score, you’re going to use 30% as a percentage, how they weigh debt, and VantageScore is going to use 21%. So even that is going to be slightly different. Okay? Also you have uh, total balances are broken down to 11%, recent behavior 5% um, and extremely low weight available credit 3%.

- 04:04 So the way they do their algorithm is slight different. It’s not going to be a massive difference in most cases. Uh, VantageScore’s original formula was drastically different from what FICO was using. These days, it’s almost a perfect match. So if you’re using Credit Karma, okay, continue using it. It’s a good little system, it’s free of charge, so I’m a big proponent of free credit monitoring services. It allows you to be in tune with what’s going on in your credit at all times. But if you’re really serious about accessing any sort of financing in the next even six months, I would suggest you move your credit monitoring um, over to a paid site. I’m going to give you a couple of them that are really, really good. Okay?

- 04:46 One of them is going to be myfico.com. Okay? Myfico.com is FICOs actual credit monitoring service. This the theirs guys, okay. It’s not cheap, though. The three-in-one uh, credit monitoring through myfico.com is somewhere in the vicinity of $30, $40, depending on which options you pick, so it is really pricey. But, when you access that report, aside from getting to credit monitoring and the alerts when you pull your credit report each month, you’re getting the data from all three bureaus, and you’re getting all the different versions of the FICO score. You’re getting the mortgage lending score, you’re getting auto lending, credit card borrowing um, all the good stuff, so you can really see the credit report the same way the banks and lenders can see the credit report, okay?

- 05:33 Um, another really good site, and I’ll give you guys a quick link, is going to be smartcredit.com/keycredit. So we’ve been working with SmartCredit, really good credit monitoring site, super awesome tech, [inaudible 00:05:53] app, [inaudible 00:05:55] your credit, and you’re getting real-time alerts. The big benefit with our SmartCredit credit monitoring, is [inaudible 00:06:02] run your credit multiple times throughout the month, and it’s just a little cheaper than myfico, it’s about $25 versus the $39. Okay? So another great resource, keep in mind, we’re not offering FICO scores through this website, okay? We’re offering an educational purposes only credit plus score, where with myfico, you’re getting exactly what the banks and lenders are seeing. Okay guys?

- 06:22 If you have any additional questions regarding Credit Karma versus your FICO scores um, how you should be pulling your credit or preparing your credit scores um, months ahead uh, from getting any mortgage lending, by all means give us a call. There should be, if you’re on Facebook, there should be a learn more button right below my finger here, click on that button, it’ll take you right to our website, you can give us a call and ask any questions. Thanks, guys.