Mortgage Process – The Dos and Don’ts

Mortgage Process – Additional Buyer Tips

Investing your cash in anything in this market can be a risky business, and also if you’re investing in property, your threat has merely tremendously improved. Just before you decide to put your money in the market as a purchaser, make certain you’re fully notified on how to come close to the real estate market. Review this write-up now!

When acquiring their following residence, pros of the armed forces need to take into consideration taking advantage of a VA finance. VA lendings provide no deposit choices, as well as all shutting prices can paid by the homeowner. There are capped factors on a VA loan also, and also one more pro can presume your financing when it’s time to offer.

When attending an open house or watching a version couch, attempt to continue to be objective. Focus on your property itself as opposed to the decor. Keep in mind, you are buying our home, not its contents. Concentrate on exactly what’s essential: square footage, the layout, wall surface space, home windows, and also doors. This will permit you to establish how well our home can fit YOUR decor and items.

Keep an open thoughts concerning the houses you look at. These were or are somebody’s couch, and while they could not have made the decorating selections you would certainly have, it was their decision.

Don’t permit that cloud your judgement if you are totally in love with a house that is on the market. Before purchasing your home, you need to ensure it is up to code, is really suitable for you, and also is valued right. Don’t miss over these vital checks, if the house is not as good as you wished, there will be other ones that you might like a lot more.

Work with a couch inspector. A residence assessor can tell you what is incorrect with the home, what is right with the property and also sharp you to any kind of instant troubles. Just before employing an inspector though, ensure to do your research and also ensure that the examiner has recommendations and also good qualifications.

When you go into the sector of realty acquiring, watch out for mortgages with balloon settlements. Balloon repayments are incredibly big repayments the home mortgage owner is needed to make at the end of the loan term. They are ethically uncertain, and also they normally suggest that the loan company is unethical. Remain away when you recognize balloon settlements!

When seeking a couch mortgage, you consistently need to analyze your choices thoroughly. There’s a worry that you will not be able to obtain a loan, so this causes some people to take the first lending they could discover.

Now that you have actually read the post, you have actually just understood lots of different suggestions as well as tricks that will all aid you to make the very best choice as a realty purchaser. Being a purchaser could be hard and also challenging. Act upon what you have actually discovered right here and you could be able to streamline the procedure dramatically.

Experts of the armed forces ought to consider taking advantage of a VA lending when purchasing their next residence. Try to stay objective when going to an open house or viewing a version house. These were or are an individual’s home, and also while they could not have made the enhancing options you would have, it was their decision. A couch inspector could tell you what is wrong with the residential property, what is best with the residential property and also alert you to any sort of instant issues. When seeking a residence mortgage, you always require to analyze your alternatives extensively.

Fantastic Pointer For Looking for The Residence Of Your Dreams

The complying with suggestions were written to assist you make the ideal residence buying choices. Review them each meticulously to discover the finest strategies to assist with acquiring actual estate.

When aiming to acquire a couch in a neighborhood, consider the size of your house. Properties differ in size in communities. If resale worth is very important in your purchase, do not buy the biggest home in the neighborhood. When determining fair market value, the residences local to yours will certainly be used. They will bring down the worth of your larger couch if many of the residences are smaller.

To obtain the best rate feasible, ask the proprietor if they would certainly approve a lesser price. Be open and sincere regarding this. Do not firmly insist if they reject this lesser price, but ensure they know the best ways to connect with you if they transform their thoughts.

If coming up with a down payment is the only obstacle holding you back from purchasing a house, see to it you have actually tired all opportunities before you write out one more rental fee check to pay somebody else’s home mortgage. Don’t hesitate to ask family and friends for aid. Turn your needless prized possessions, such as a watercraft or diamond earrings, right into cash money. Borrow from your IRA. Obtain a sideline. Search for fundings from non-profit organizations. Cash in your life insurance provider value. Do whatever you could to turn your desire right into a truth.

If you are interested in purchasing a brand-new residence make certain that you look at a few choices before making a final decision. Being too rash may result in you losing out on seeing a property that might be more of a suit of just what you are trying to find.

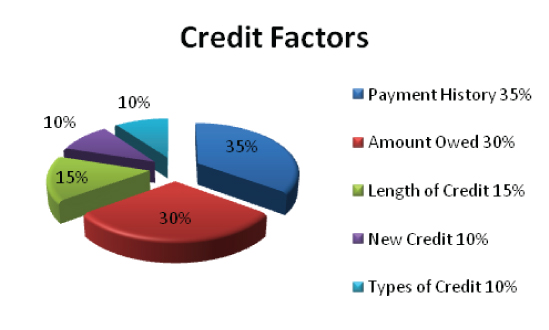

If you want getting a couch, you ought to resist on making any kind of significant investments around that time. Acquiring big products could bring down your credit report a bit, which would certainly mean that you could not obtain the very best price when you are wanting to secure a home loan.

Earnings assessment is commonly made use of, because several financiers are looking to make sure that the monthly income covers all regular monthly expenditures, including the home loan as well as tax payments. Another generally made use of method is identifying the replacement value of a specific property.

Since you have located these great suggestions for purchasing real estate, use them to your advantage. You are going to need to deal with the decisions that you make at this point in time for years to come. If you apply the discovered suggestions to your buying strategy, you are certain to do well.

The adhering to suggestions were composed to assist you make the best house acquiring decisions. When looking to buy a house in an area, take right into consideration the size of the property. The houses closest to yours will certainly be made use of when identifying fair market worth. If many of the houses are smaller, they will bring down the value of your bigger couch.

If coming up with a down payment is the only barrier holding you back from buying a couch, make sure you have exhausted all methods prior to you create out another lease check to pay somebody else’s home loan.

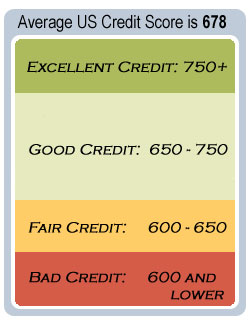

For more information on how to repair credit, Sign Up for $0 Today.