Should You Ever Close an Old Credit Card? – Key Tips

Better rates and more rewards entice us to apply for better credit cards. But what should you do with an old card? Debt management can be tricky if you’re tempted by all your cards.

It seems like the obvious solution is to just cancel the old card. But before you do that, it’s important to understand how canceling a card can impact your credit.

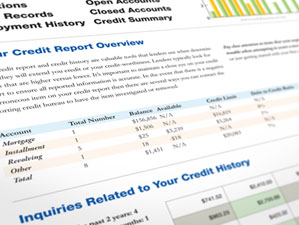

How Credit Reports Work

Credit reports look at five important areas:

- Payment history

- Credit utilization

- Credit history

- New credit

- Types of credit

Some of these will be directly impacted whenever you close a card.

Payment history will stay on record for up to 10 years, so you don’t need to worry about that.

Credit utilization, however, will be directly affected. This looks at your debt-to-credit ratio. If the card you’re canceling had a $10,000 maximum, your total credit maximum will also drop by that amount, which can make any used-up credit seem worse.

Credit history will also be impacted, especially if the card was an old one. If this was your first source of credit opened 10 years ago, that means your history spans 10 years. If the next card you got was only five years ago, closing the older one will shorten that credit history by five years.

Peace of Mind

Despite the potential blow to your credit report, your unique situation may warrant canceling a credit card.

If you’re no longer using the account, you might not log in regularly to view activity. If you’re not paying attention to what’s happening to that card, you’re at greater risk for identity theft. If the card doesn’t have a lengthy credit history or high limits, it might be safer to close it.

Whether or not you close a card should also be dependent on your behavior. If you know you’ll have a hard time resisting using that card, you’ll probably be better off removing that temptation entirely.

Important Things to Consider

- It’s fine to have several credit card accounts open, as long as you’re not tempted to use them all

- If you do close your card, be sure to pay off the balance and redeem rewards prior to canceling

- Don’t forget to change any automatic payments on your old card

- Don’t close a card before a major purchase

Do You Need Help with Your Credit?

If you need to repair or improve your credit, or simply have questions, we offer Sign Up for $0 Today. We’d be happy to walk you through the credit repair process and get you back on track. Feel free to Sign Up for $0 Today.